Rethinking Segmentation and Targeting During the Pandemic

In our Perspectives article, Regaining Revenue Confidence, we highlighted the importance of balancing fit, intent, and risk in ensuring a successful go-to-market strategy – especially in times of economic uncertainty. In this post we’ll dive deeper into applying this framework to help segment the market and tailor targeting strategies based on the impact of COVID-19 across industries. One of the most widely used segmentation strategies is by industry – and this is especially important as organizations are being impacted in vastly different ways by the pandemic.

Recently Dun & Bradstreet has analyzed over 35 million accounts across 125+ customer pipelines and found that 21% of pipeline accounts on average are facing high financial risk. We define financial risk as a combination of factors, including slow payment, bankruptcy, unpaid debt, and business viability, derived from our proprietary trade data. We continue to keep a close eye on this number, but that is a jarring statistic that demands attention as it relates to go-to-market strategies.

But we’re seeing some industries being harder hit than others, so this begs the following question: How should targeting strategies shift based on impact by industry?

We have analyzed 125+ customer pipelines over 3 weeks:

|

| Figure 1: Average Risk Impact Across 125+ Pipelines Analyzed. |

At Dun & Bradstreet, this has been a hot topic of conversation in order to help our customers improve performance during challenging times. A survey by Dun & Bradstreet during a recent webinar for D&B Hoovers™ customers showed that 58% of sales teams are seeing a decline in first meetings since the beginning of 2020.

Michael McCarroll, our Chief Revenue Officer for Digital Marketing Solutions, summarized this new reality eloquently: “The dominant theme of our customer conversations today is how to be both sensitive and impactful in the new environment. We have found the new environment has unleashed entirely new forms of sales and marketing campaigns – far less driven by self-positioning and more characterized by seeking to meet customers where they are.”

To stand out from the crowd and connect with your audience in a B2B setting, sales and marketing teams must consider three core actions:

- Know who is ready versus not ready – which accounts are in market given the shifting priorities and industry dynamics?

- Select messaging appropriate for the time – how can you tailor your message in a way that incorporates the industry and financial challenges your accounts are facing?

- Write a new playbook that is sensitive and adds value – how can your capabilities be a part of the solution to help your customers through this time?

To achieve these three objectives, you must have a deeper understanding of impact across industry categories. To help sellers and marketers categorize accounts in a simpler way, we’ve developed five key categories of industries that are seeing a differing impact due to the pandemic. Each category is seeing vastly different impacts across buyer demand, operational strain, and financial viability.

- Essential: Companies classified as requiring operation during the pandemic to ensure safety, security, and health. Examples include grocery stores, hospitals, and farming operations.

- Supports Remote Work: Companies classified as being able to support a remote workforce. Examples include cloud software vendors, credit reporting agencies, and insurance carriers.

- Requires Human Interaction: Companies that require face-to-face human interaction to operate. Examples include hotels, dine-in restaurants, and retail department stores.

- Delivery-Based Retail: Companies that retailers rely on for the delivery and distribution of their goods or services. Examples include courier services, air courier services, and local trucking companies.

- Central Production: Companies that manufacture or distribute raw materials or utilities for central production. Examples include food processing, oil and gas, mining and logging, and gas/electric/water/sanitation services.

| Essential | Supports Remote | Requires Contact | Delivery-Based Retail | Central Production |

|---|---|---|---|---|

| 01, 02, 07, 09, 17, 27, 48, 52, 54, 55, 60, 61, 72, 75, 80, 83, 92, 97 | 47, 60, 61, 62, 63, 64, 65, 67, 72, 73, 78, 81, 82, 86, 87, 88, 89, 91, 92, 93, 94, 95, 96, 97 | 41, 44, 45, 47, 52, 53, 55, 56, 57, 58, 59, 65, 70, 72, 73, 75, 76, 78, 79, 80, 82, 83, 84, 99 | 42, 45, 59, 73 | 8, 10, 12, 13, 14, 15, 16, 17, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31, 32, 33, 34, 35, 36, 37, 38, 39, 40, 42, 43, 44, 46, 47, 49, 50, 51, 59, 65, 73, 75, 76, 78, 87, 95 |

|

|

|

|

|

| Figure 2: Breakdown of SIC 2 Codes by Category and Examples | ||||

Beware that not all verticals will be impacted in the same way despite playing in the same industry. This won’t be as easy as listing your target accounts under each category and crafting a message. We’re seeing some companies thrive and others struggle despite playing in similar spaces – purely due to their go-to-market strategy.

For example, despite both TripActions and DocuSign playing in the software space, DocuSign is aggressively hiring to meet demand for their offerings[i] while TripActions has seen a decline in revenue due to travel restrictions[ii]. This is where risk-adjusted segmentation helps you prioritize accounts that may be in a similar vertical but have completely different impacts due to the pandemic. While some companies may be healthy financially, their suppliers may be severely impacted – thus putting a strain on operations.

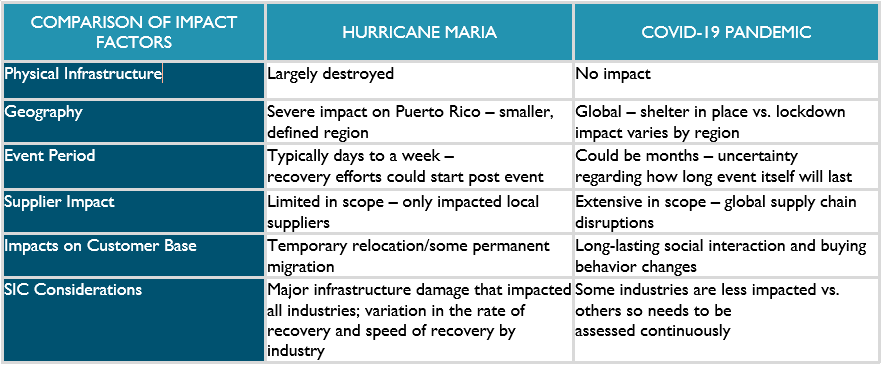

All of this is to say that financial health or industry alone is not sufficient – multiple factors beyond these must be considered to better understand the impact of the pandemic to better prioritize targeting strategies. At Dun & Bradstreet, we’ve learned this through other natural disasters we’ve helped our customers through. While pre-disaster financial health has a significant impact on post-disaster recovery, impacts on customers and suppliers are critical to consider as well. This is why industry, customer, and supplier network relationships are a core component of our COVID-19 Impact Index.

|

| Figure 3. The differences in impact factors across Hurricane Maria vs. the COVID-19 pandemic. |

Despite the promise of martech to enable speed and scale for your go-to-market strategy, this is a time to hit the pause button and rethink your go-to-market approach. Don’t sacrifice tailored messaging for the sake of scale and speed to market – the additional thought you put in now to think about fit, intent, and risk will pay dividends when your audiences notice you’re empathizing with them and offering real value that aligns to the specific challenges they are experiencing. If you haven’t already done so, be sure to take advantage of our complimentary Pipeline Health Scan to assess how your accounts may be impacted. We hope these insights will help you rethink your go-to-market playbook to not only be more sensitive, but also to offer tangible value based on the unique challenges your accounts are currently facing.

[i] Source: VentureBeat, “Candor: 267 companies have frozen hiring, 44 had layoffs, 36 rescinded offers, 111 are hiring”. March 28, 2020

[ii] Source: Business Travel News, “Amid Layoffs, TripActions CEO Pushes R&D” March 31, 2020