Real Customers, Real Results

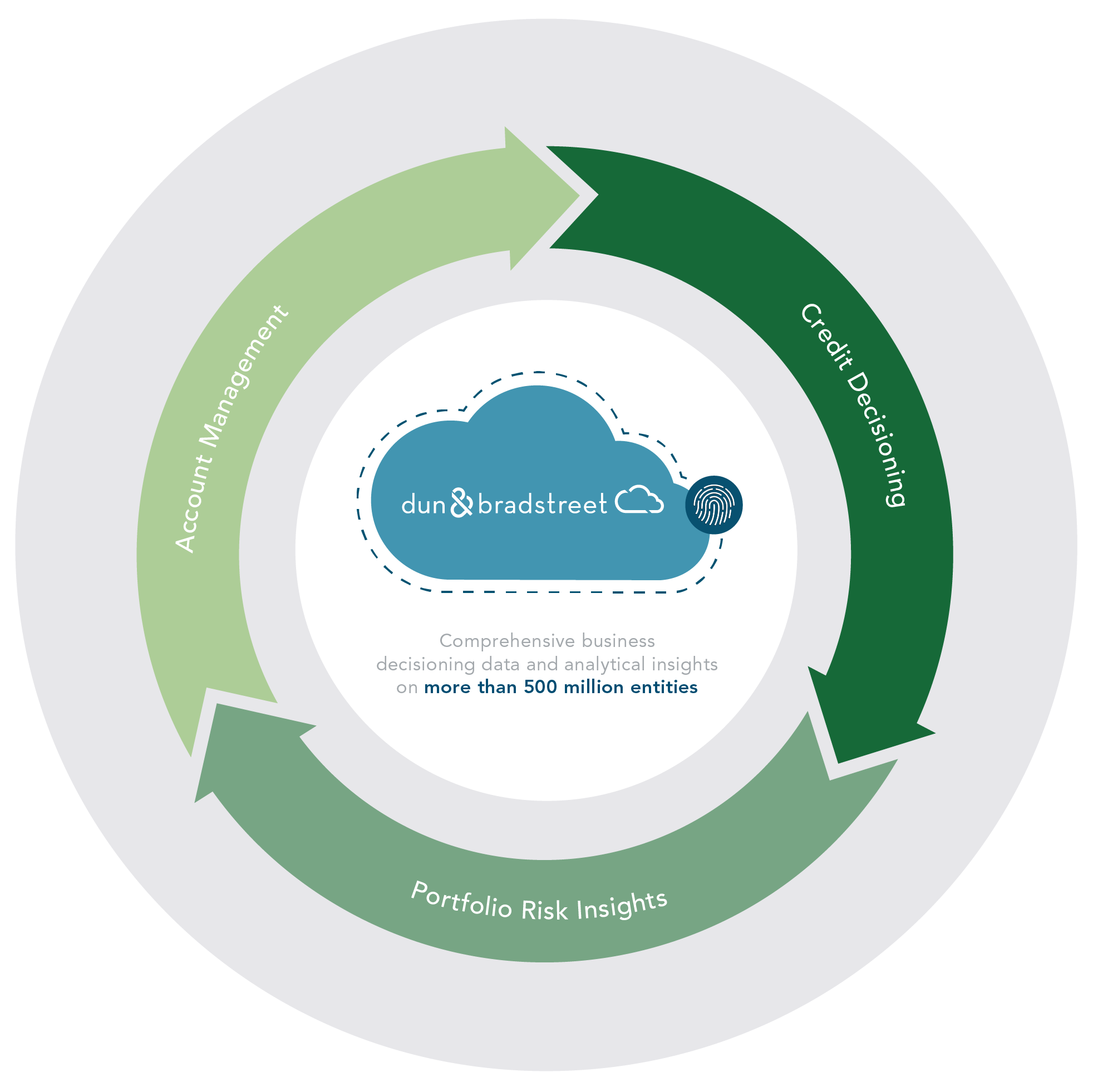

Access the world’s largest global commercial credit database to make smarter lending and credit risk decisions. This includes trusted predictive scores and globally consistent credit limits which make it easy to onboard customers and come to the right decisions.

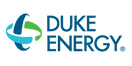

Powered by D&B’s Data Cloud, by D&B Finance Analytics is a flexible and easy-to-use credit management solution, allowing you to achieve less risk and more reward.

From large enterprises to sole traders, make smarter credit risk decisions with our Unified Risk View, enhanced by TransUnion’s UK consumer data*.

We can provide you with the confidence to make smarter decisions about business customers with comprehensive coverage of UK businesses, helping you to automate risk decisions for new customers, better manage your existing portfolio and act decisively on early signs of distress.

*Restrictions may apply to the use of TransUnion’s UK Consumer data depending on the size and type of the business in question.

Alongside access to D&B’s comprehensive global business data, our Unified Risk View helps you make confident credit risk decisions on UK businesses of any size with just one credit risk management solution – D&B Finance Analytics.

It provides you with the confidence to make better decisions about your customers – from multinationals to sole traders.

Gain better understanding of overseas business and evaluate risk with access to structured, consistent data and risk analysis.

With standardised scores and ratings, our credit risk management solution ensures you have information you need to make smarter credit and lending decisions for businesses across the globe.

Increase confidence when evaluating new business opportunities: expand outside your existing customer portfolio base by efficiently assessing third party risk using real-time reliable global data.

Maintain high security standards with a trusted partner: with a Privacy Program focused on personal data compliance.

Expand your reach into the millions of UK small businesses, expediting new business while consistently controlling credit risk for new and existing customers.

Monitor ongoing progress and identify directors’ high-risk activity before it reflects in their business financials, take faster action and update rates.

Like people, businesses evolve and grow. However, these changes make it hard to be sure who you are doing business with, especially when operating internationally.

That’s why our D-U-N-S® Number is at the heart of what we do at Dun & Bradstreet. A D-U-N-S Number is used to maintain the latest information on hundreds of millions of businesses around the globe – forming the foundation of how we create business records and providing an in-depth view of ownership and linkage.

Anchored by the Dun & Bradstreet D-U-N-S® Number, D&B Finance Analytics includes predictive and performance-based scores and ratings, and global information to help the businesses make credit and lending decisions.