Case Study: D&B Failure & Delinquency Predictor Scores

Find out how the D&B Failure and Delinquency Scores accurately predicted the insolvency and eventual demise of LloydsPharmacy through predictive analytics.

LloydsPharmacy: Who Are They?

LloydsPharmacy, a prominent healthcare provider with a strong presence on the UK high street, has recently faced significant financial challenges. The pharmacy business owed a substantial £293 million to over 500 creditors. At the start of 2024 it filed for voluntary liquidation, ending its visible presence.

Its retreat from UK high streets began as far back as 2017, when it announced plans to exit up to 190 branches from its 1,600-store estate due to government funding cuts and higher operating costs. The pharmacy chain faced financial pressures at the time, leading to a pre-tax loss of £148 million in the year ending March 2017.

Fast forward to 2021, and the healthcare chain employed over 2,500 pharmacists across nearly 1,300 pharmacies. But in the same year, the business was sold to investment firm Aurelius UK for £477 million. This kicked off a divestment campaign, during which the firm sold off its store estate of 1,054 high street and community pharmacies. These pharmacies were purchased individually or in regional packages by independent pharmacy owners and local entrepreneurs – with over 6,500 branch colleagues transferred as part of these sales.

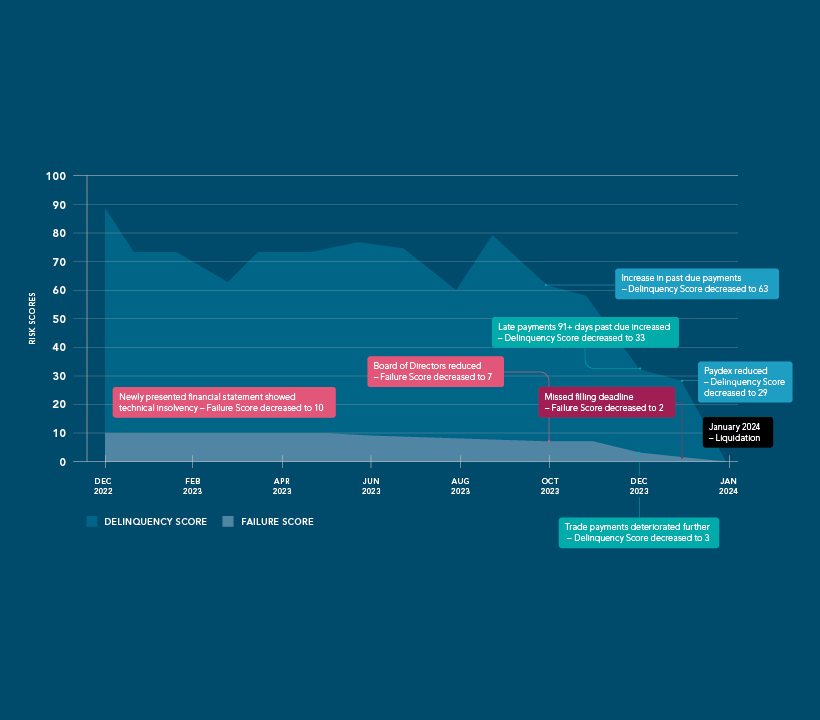

The following case study demonstrates how the D&B Failure and Delinquency Scores accurately predicted the declining financial situation and eventual insolvency of LloydsPharmacy.

Predicting financial stress

How does the D&B® Failure Score work?

The D&B Failure Score predicts the likelihood that an organisation will obtain legal relief from its creditors or cease operations over the next 12-month period.

The D&B Failure Score is a relative measure of risk, whereby 1 represents organisations that have the highest probability of failure and 100 – the lowest.

It shows how an organisations risk of failure compares to other organisations within a country.

How does the D&B Delinquency Predictor Score work?

The D&B Delinquency Predictor Score predicts the likelihood that a company will pay in a severely delinquent manner, seek legal relief from creditors, or cease operations without paying all creditors in full during the next 12 months based on information in the Dun & Bradstreet Data Cloud.

The D&B Delinquency Score is dynamic, meaning that it is recalculated every time we collect a new piece of information about an organisation, or when information changes.

How We Can Help

D&B collects information from tens of thousands of sources globally. Our predictive risk scores use demographics, corporate linkage, principals, financial, trade experiences and public detrimental information to predict how an organisation is likely to behave in the future.

Utilising the insight provided by D&B’s Predictive Indicators helps customers to quickly identify the organisations that are likely to fail or pay late, helping to drive growth, mitigate risk and increase profitability.

Our data and predictive indicators provide our customers with accurate and timely insight into an organisation may be heading for failure. D&B's monitoring services can be used to identify key changes to an organisation, allowing our customers to take appropriate and timely action.

Predictive Indicators can be adjusted by authorised experts to reflect non statistical/catastrophic events. For example, news reports from trustworthy sources that indicate a material change to risk can be investigated and changes made where appropriate. We also apply expert rules (sometimes referred to as overrides) in certain situations to ensure appropriate scores.

Have questions? We are ready to help. Contact us now.